Cheyenne Federal Credit Union: Your Source for Reliable Financial Services

Cheyenne Federal Credit Union: Your Source for Reliable Financial Services

Blog Article

Federal Cooperative Credit Union: Your Trick to Better Banking

Federal Cooperative credit union provide an one-of-a-kind approach to financial that prioritizes their members' financial wellness. With a focus on offering tailored services and affordable prices, they stand out as a customer-centric and cost-efficient option for people looking for to attain their economic goals. But what collections Federal Credit scores Unions besides standard financial institutions, and why should you think about making the button? Allow's explore the key advantages that make Federal Cooperative credit union your gateway to better financial options.

Benefits of Federal Lending Institution

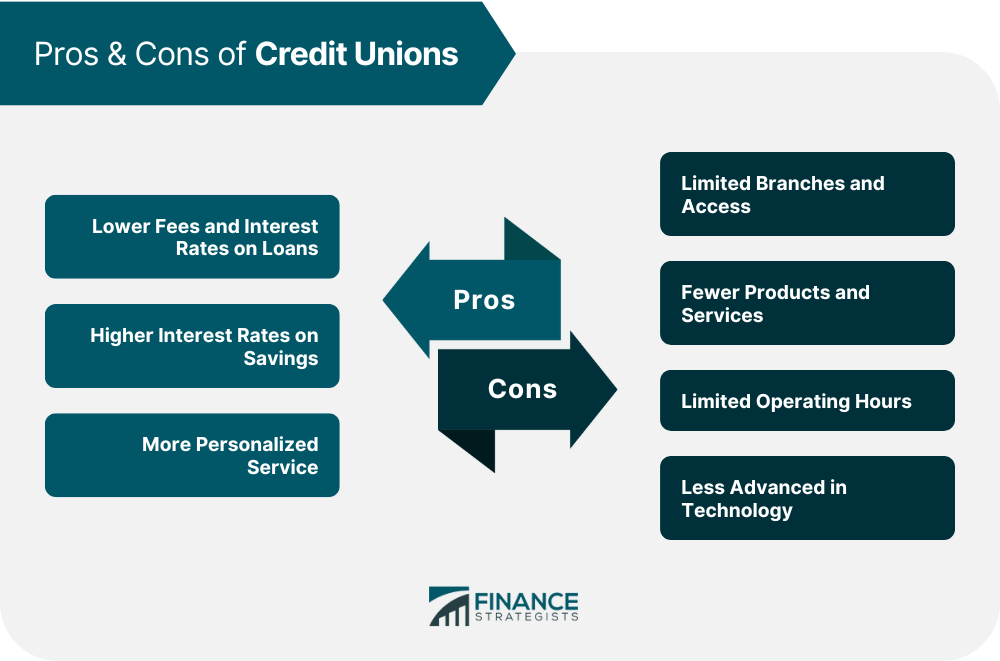

Federal Lending institution offer a variety of advantages for members seeking a much more customized and community-oriented banking experience. One significant advantage is the emphasis on serving their participants rather than making best use of earnings. This member-focused technique often translates right into higher passion rates on interest-bearing accounts, reduced rate of interest on loans, and less fees contrasted to typical financial institutions. In Addition, Federal Credit Unions are recognized for their commitment to economic education and therapy. Participants can access resources to enhance their financial proficiency, make much better decisions, and work in the direction of their long-term goals.

Federal Credit score Unions often have solid ties to the neighborhood area, supporting small companies, charities, and initiatives that benefit their members. In general, the benefits of Federal Credit report Unions develop a more encouraging and inclusive financial atmosphere for those looking for a customized and community-centered method to fund.

Member-Focused Providers Supplied

With a solid emphasis on member contentment and financial well-being, Federal Lending institution supply a varied series of member-focused services tailored to meet private requirements. These specialized solutions go beyond conventional financial offerings to guarantee that members receive tailored focus and assistance in accomplishing their economic goals. One essential service offered by Federal Lending institution is monetary therapy and education. Members can profit from professional support on budgeting, conserving, and investing, assisting them make notified choices regarding their finance. Additionally, Federal Lending institution often provide accessibility to unique participant rewards such as discounted prices on car loans, greater rate of interest on interest-bearing accounts, and waived costs for sure transactions. Another important member-focused solution is individualized account monitoring, where participants can get tailored support based upon their distinct financial conditions. By prioritizing participant requirements and offering tailored solutions, Federal Lending institution stand out as organizations committed to supplying excellent financial experiences for their participants.

Affordable Rates and Costs

When it concerns borrowing money, Federal Cooperative credit union typically supply reduced passion prices on financings, consisting of automobile car loans, home loans, and individual car loans. This can result in significant cost savings for members over the life of the loan contrasted to obtaining from a standard bank. Additionally, Federal Lending institution usually have less and lower charges for solutions such as overdrafts, atm machine usage, and account maintenance, making them an affordable alternative for people seeking economic solutions without too much fees. By focusing on the economic health of their members, Federal Lending institution remain to attract attention as a dependable and inexpensive banking choice.

Financial Goals Accomplishment

A key facet of handling personal financial resources successfully is the successful accomplishment of financial objectives. Setting clear and attainable monetary goals is important for individuals to function towards a secure financial future. Federal credit rating unions can play an important role in helping participants accomplish these objectives with various financial services and products customized to their requirements.

One typical economic objective is saving for a significant acquisition, such as try here a home or a cars and truck. Federal lending institution use affordable savings accounts and investment choices that can aid participants expand their money with time. By functioning carefully with participants to understand their objectives, lending institution can provide customized suggestions and services to promote cost savings purposes.

An additional important economic goal for numerous individuals is debt repayment. Whether it's pupil car loans, credit rating card financial debt, or other responsibilities, government credit scores unions can offer debt consolidation lendings and financial debt management techniques to assist members repay debt effectively. By decreasing rates of interest and simplifying payment timetables, credit score unions sustain members in achieving financial liberty and stability.

Why Select a Federal Cooperative Credit Union

Federal debt unions stand apart as advantageous banks for people seeking an extra individualized method to banking solutions tailored to their economic goals and specific demands. One main reason to pick a federal lending institution is the member-focused approach that controls these institutions. Unlike typical banks that focus on revenues for investors, lending institution are owned by their members, meaning the focus is on supplying value and advantages to those that bank with them. In addition, federal debt unions commonly blog here supply lower costs, affordable interest rates, and a more customer-centric strategy to solution. This translates right into price savings and a more tailored financial experience for members.

Verdict

In final thought, Federal Lending institution use a member-focused method to banking, providing affordable rates, customized solutions, and support for achieving financial objectives. Credit Unions Cheyenne. With greater rates of interest on cost savings accounts, lower rate of interest prices on loans, and fewer costs than standard banks, Federal Lending institution stick out as a customer-centric and economical selection for individuals looking for better financial alternatives. Choose a Federal Lending Institution for a much more economically protected future

Federal Credit history Unions provide an one-of-a-kind technique to financial that prioritizes their members' economic health. By prioritizing member requirements and supplying tailored services, Federal Credit history Unions stand out as institutions dedicated to giving superior financial experiences for their members.

By focusing on the economic wellness of their members, Federal Credit history Unions continue to stand out as a trusted and budget friendly financial option.

Whether it's student finances, credit report card financial obligation, or various other responsibilities, federal credit report unions can offer consolidation lendings and debt management strategies to help members pay off financial obligation efficiently (Credit Unions Cheyenne).Federal credit history unions stand out as beneficial monetary establishments for individuals seeking a much more personalized method to financial services customized to their economic goals and particular requirements

Report this page